By Lakshini Dahanayaka

The time has come to adopt to an uncertain lifestyle today and we should always keep in mind that this is the new normal across almost all countries in the world. Firstly, we have to understand that we cannot spend like we did earlier. As a prelude to facing uncertainties, we need to continue setting aside a part of the cash inflow as savings for the future.

When a curfew or a lockdown situation is announced, people tend to purchase groceries and day to day items in bulk, even if these purchases are not essential nor of much use. However, since most supermarkets and small scale vendors do door to door delivery, we should not make unnecessary purchases in one go but spread the expenses across daily essentials as and when required. This way we not only save money but also cut unnecessary expenditure.

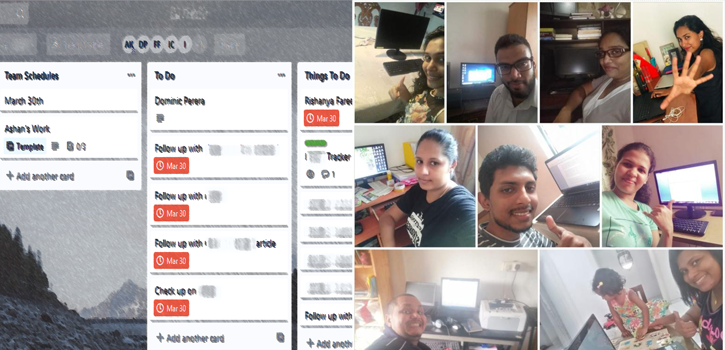

With the current situation we are compelled to stay at home and unable to meet our family and friends. This leads to an increase in the use of social media to alleviate our loneliness and also to keep in touch. In addition, most parents are Working from Home and children are to continue their educational activities on e-Learning platforms while although the increased cost for internet usage is not immediately realized, this may end up absorbing a huge amount of expenditure. This can be avoided by adopting to data packages which suits your usage requirements.

Another expenditure which usually increases during a lockdown is your household electricity charge. Since most of the family members are at home, the number of electric equipment which are plugged in is increased due to work from home and learn from home activities. Therefore, whenever possible we need to be conscious of this and switch of fans, lights and other electric equipment when not required.

Parents should also be careful when continuing or getting on board with insurance schemes for themselves and the children. Since most parents have to undergo pay cuts and job losses you can always speak to the insurance partners and change policies to more affordable premiums until the economy and job security is stable once again.

We should also be mindful of subscribing to new services such as magazines, mobile services and TV channels which we have to incur a monthly expense for. These may not be essential during this time and will be an unnecessary cost which has no gain.

We all are going through a difficult time right now and it is difficult for us to determine right now what the future hold. We need to manage our spending well in line with the situation. Everyone has the ability to increase savings by cutting unnecessary expenses, therefore ensure that you think twice before spending.

Ends