By Lakshini Dahanayaka

“The COVID plague has impacted every sector and all walks of lives and has a tremendous impact on the economy and of course all finance elements. Let us look at a few steps on how to manage the COVID -19 time period as it is an intensifying challenge’’.

Financial Management seems like two serious words. Most would think hard and try to figure out its meaning. As individuals we manage day to day money in our own way. Simply we called this exercise “Money Management” in a perspective of an individual. At a corporate level it is known as “Financial Management”. Financial Management is significant to both individuals and businesses.

The world face different types of calamities from time to time. We are presently facing such a calamity in the form of the COVID -19 outbreak. As never before, this epidemic affect the financial condition of all individuals as well as businesses and institutions, and is presently deteriorating. In this limelight, proper management of money is very important. Businesses are run by people, the start to all financial management comes from personal financial discipline and it’s the nucleus of all decision making.

PERSONAL FINANCIAL MANAGEMENT

Most of us Sri Lankans rely on a monthly salary, self-employment and subsidies from the government. What I suggest for you to do is to divide your money at hand into two parts: the present and the future.

As the first step, you need to make a list of how to spend the present reserved amount for most essential items.

When you use your electronic cards you are prone to misuse or purchase products or services which are not essential. Remember the situation you are in at this moment, you to spend wisely for what is necessary.

Why do you think I say that we need to allocate one portion of your money for future? It is because we are not really sure for how long the impending crisis will last. We are now at a critical stage where our job security is our main concern.

In terms of your utility expenses, your personal consumption of electricity, water mobile and internet services will lead to an increase. The current weather around many parts of the island will not help the course as well. As brim of hope lies in the monsoon season. Hence controlling and discipline of your utility consumption is really important.

CORPORATE FINANCIAL MANAGEMENT

Economical shutdown and lockdowns is coming in to play and is currently taking place in many large, medium corporates and SMEs and Start-Ups as we speak. Small offices are filing for bankruptcy especially in the apparel, tourism, aviation construction, retail and service sectors.

Whatever you may encounter during this period, my view of maintaining a proper relationship between Financing Input, Process and Output is imperative. Ad-hoc project budgets and new projects will be halted and their financial budgets will be frozen and reconsidered by the CFOs of all companies together with the Management Committees.

To maintain this relationship, in our mode of business, being a Public Relations counsel, the client/customer, (who is the financial input), must be kept happy though how bad the market controls look to us. The true meaning of ‘bending backwards’ would apply in this scenario. More bargaining power and negotiations will be heading your way. It is your responsibility not to lose your client, at this vital stage and also not to harm the long term financial forecast of your company.

From the Macro Environment point of view, inflation is rising, and so is the cost of living. Financial institutes, Banks are also pressured with Monetary Policies by the Central Bank of Sri Lanka and Government Directives. Our foreign reserves are getting affected. The Central Bank has requested remittances of foreign currency through our expat and business communities.

This means our employees, our suppliers would also incur and experience an increased cost of living. We would need to go back to the drawing board and understand what supplier services are required or reconsider whether these agreements are needed. Procuring a supplier that offers value for money is key during this situation.

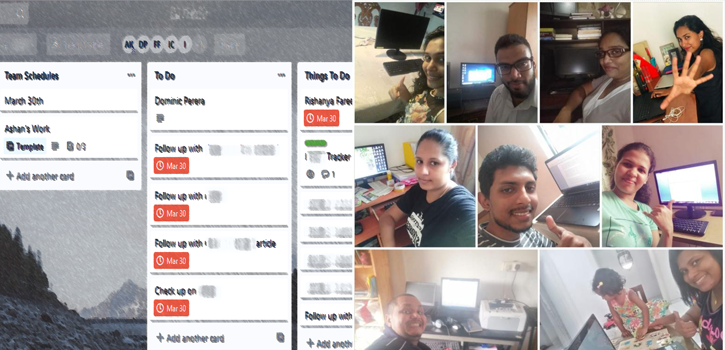

Since mid –March the public and private sector are adhering to the Work from Home Concept. Fixed cost for any business such as salaries, supplier payments and utility payments will persist. Financial Team are now tearing their hair off trying to remake cash projection due to the negative sales affect.

The projection which is also known as financial process will help you realize how much costs you would need to sustain the basic fixed cost as cash flow is stopped. In my view, business in the service industry particularly needs to maximize the utilization of internal resources, re-look at internal processes and reduce external costs and efficiency.

If you are considering, investments in new business pause a moment and relook at your focus. Your strategizing would also tell you that the Investments you are currently making would not bring you the returns you expected. I suggest you to think of more innovation in terms of your product and service offering.

This period can be described as the most used period of digitization, businesses like us would do better by maintaining this further. Businesses annual reserves are now re-designed to focus more on operational expenditure.

The US Dollar as we speak has climbed to over LKR 190. As policy limitations are made only focusing on essential services such as Healthcare and food as imports it is considerably hitting many retail networks interns of supply chain. This is how the final output comes to play which connects the expense mechanism adapting to financial management practices during the COVID – 19.

We should understand that your income is less and expenditure would be higher. This applies to both individuals and businesses. Thinking twice whether you require certain needs and wants would help you survive financially during this challenging period.